While there’s never a ‘perfect time’ to do estate planning, it’s not something to be put off. I tend to do a lot of estate planning after the holidays and start of the New Year; it just seems to be the right time for many people.

Sometimes, I run across clients who do the planning on their own, or through LegalZoom or other on-line so-called legal providers. The one thing I consistently notice when I see this is the lack of depth involved in ‘do-it-yourself’’ estate planning. With estate planning, it’s not enough to get the right answers; you have to start with the right questions.

I’m reminded of a case from my law school years.

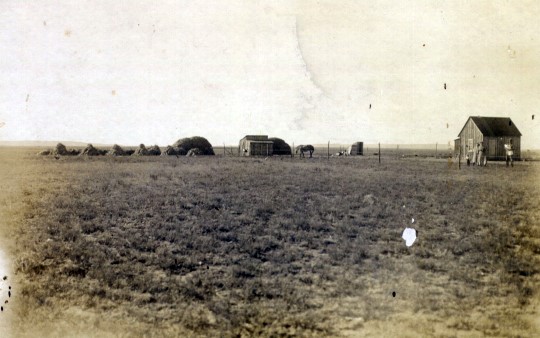

There was an eccentric old man, who lived in the middle of nowhere in Texas. He lived on a rundown old farm, hoarder-like, though friends and family knew he had made a small fortune in oil a generation earlier.

There was an eccentric old man, who lived in the middle of nowhere in Texas. He lived on a rundown old farm, hoarder-like, though friends and family knew he had made a small fortune in oil a generation earlier.

He had been a wildcatter, he amassed his fortune on his own, he made it clear to everyone who had an interest that he was going to disperse it as he saw fit. Good for him.

In short, he did his own estate planning, let it be known that he had a Will and was not above changing it if any of his heirs displeased him. Since he lived hundreds of miles from the nearest town, perhaps all this was just his way of making sure family visited him with some regularity.

He got sick, died fairly quickly. After his well-attended funeral, his family descended on the farm en masse to search for his Will.

It began civilized enough, the family systematically went through the house looking in all the normal places ~ desk, file cabinets, shoeboxes, cookie tin ~ to no avail.

They couldn’t find it in any of the ‘normal places.’ Soon it was civilization be damned, the house was a dump anyway, and they tore up the furniture, ripped through the walls, pried up the floorboards, dug up the basement, checked the well, you name it, looking for the elusive document.

They brought in bulldozers, dug up huge mounds of dirt, systematically dismantled the barn. No Will anywhere. Nothing.

Finally, after weeks on site, bedeviled by the heat, fire ants, blackflies, they got around to an ancient chicken coop far from the house. Where they found a mason jar under the floorboards.

In the mason jar was a key, obviously to a safety deposit box. It had numbers engraved on it, but no other identifying features.

The potential heirs’ problem was daunting: there were some thirty banks within a three-hundred-mile radius of the ‘ranch’, none closer, many, many more the further one radiated out. There was nothing in the house to indicate that the deceased even had a bank account. The only way to figure it out in the pre-internet age was to pick a direction, drive to a town, go bank to bank to bank trying to match the key, repeat.

It took months. At long last, they found the bank that issued the key and the old man’s safety deposit box. The key fit, it turned, out slid a good-sized box filled with documents, securities, the works. On top of it all was a handwritten note on the deceased’s letterhead. Here’s what it said:

“You will find the key to this safety deposit box in a mason jar under the boards of the chicken coop.”

The moral of the story and what I always advise clients is that when you try to do estate planning yourself (the DIY approach), and don’t get good legal advice, sometimes what seems perfectly clear to you may not be at all clear to anyone else.

And if you’ve gone to all the trouble of doing your Will and it can’t be found by your heirs, intestacy laws apply (meaning no there’s no Will) and the state’s formula, not yours, will determine who gets what, not a good ending.